Operadora de Sites Mexicanos

Operadora de Sites Mexicanos

Strength and

profitable

growth

2022 ANNUAL REPORT

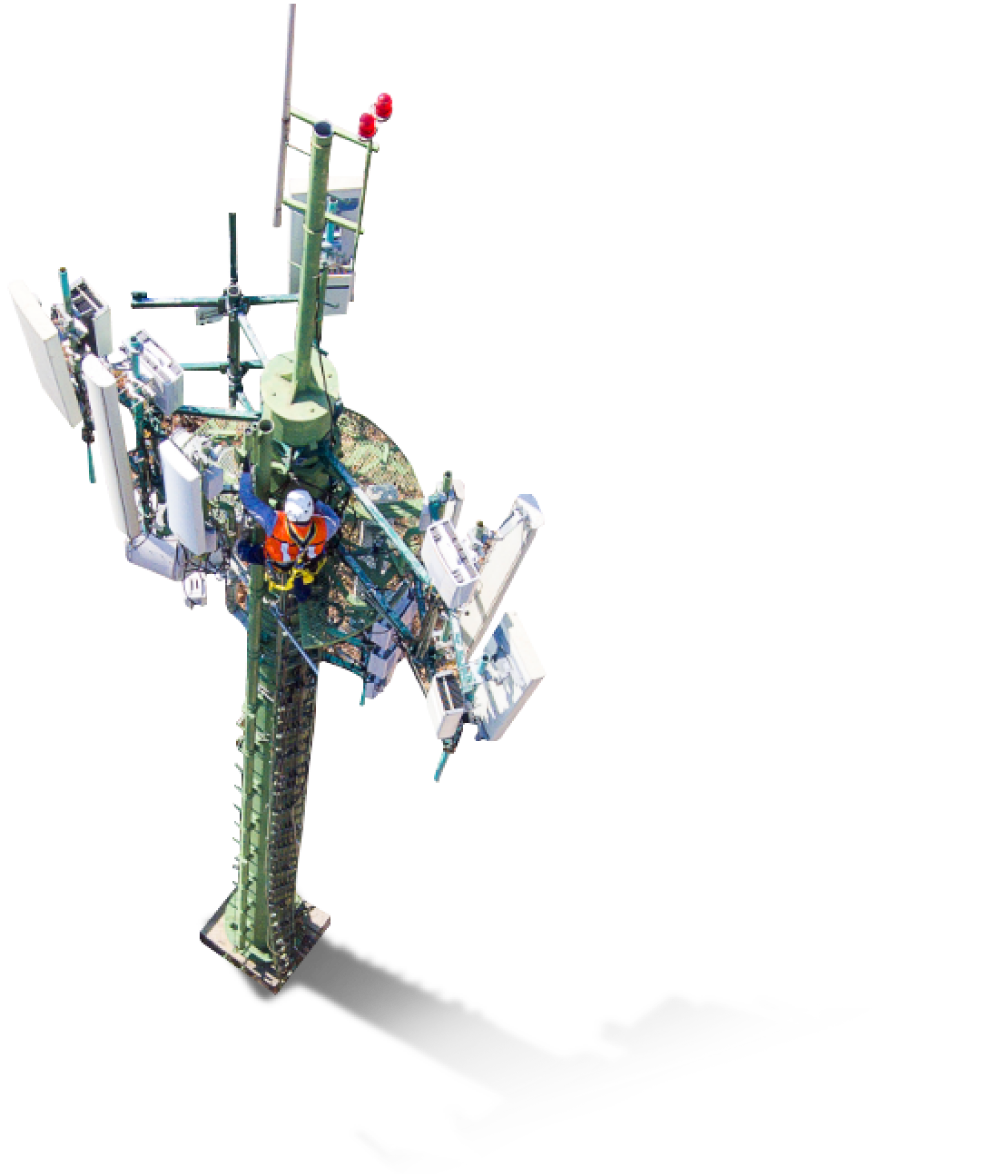

About the company

Operadora de Sites Mexicanos (Opsimex) is a Mexican company that builds, installs, maintains, operates and sells various types of passive telecommunications infrastructure—towers and support structures, physical spaces and other non-electronic elements. It is the largest tower operator in Mexico, and it has more than 21,000 towers spread across nine regions of the country as well as Costa Rica.

The steady pace of technological evolution has brought a constant growth in user demand for data services, which in turn means our clients have a growing need for passive telecommunications infrastructure. This promises significant growth potential for our company.

Opsimex added

1,653

sites to its portfolio and gained 630 additional rentals from colocations

The expansion of new towers was due to the purchase of 388 towers in December, as well as improved coverage of our clients’ telecommunications network and increased capacity in some towers in rural and urban areas.

OPSIMEX AT A GLANCE

| REGION | SITES |

|---|---|

| 1 | 904 |

| 2 | 1,497 |

| 3 | 1,333 |

| 4 | 2,353 |

| 5 | 2,664 |

| 6 | 2,402 |

| 7 | 3,769 |

| 8 | 2,816 |

| 9 | 3,657 |

21,702

TOTAL SITES

MEXICO: 21,395

Opsimex: 8,273

FSites: 13,122

COSTA RICA: 307

CORPORATE STRUCTURE

Operadora de Sites Mexicanos, S.A.B. de C.V.

72.5%

100%

| Towers in Mexico (OPSIMEX) included in revenues |

Towers in Mexico (FIBRA) included in revenues |

Towers in Costa Rica included in revenues |

|

|---|---|---|---|

| December 31, 2019 | 16,961 | - | 299 |

| December 31, 2020 | 11,292 | 6,591 | 304 |

| December 31, 2021 | 8,059 | 11,683 | 307 |

| December 31, 2022 | 8,273 | 13,122 | 307 |

TO OUR INVESTORS

TO THE GENERAL SHAREHOLDERS’ MEETING AND BOARD OF DIRECTORS OF OPERADORA DE SITES MEXICANOS, S.A.B. DE C.V.

In accordance with article 44 section XI of the Mexican Securities Market Act, in correlation with article 172 of the General Business Corporations Law, and in my capacity as Chief Executive Officer of Operadora de Sites Mexicanos, S.A.B. de C.V. (the “Company” or “Opsimex”), I am pleased to present this report on the Company’s operations during the fiscal year ended December 31, 2022.

2022 Economic Overview

Around the world, economic growth in 2022 was marked by the dynamics of a second year of recovery from the COVID-19 pandemic in 2020. Global GDP grew 3.4%, according to the IMF. The United States economy expanded by 2.1% in 2022, driven by consumer spending on services, which offset the drop in durable and non-durable goods (down -0.4% and -0.5%, respectively). Gross fixed investment rose 4.0% despite the 10.6% plunge in housing investment.

In Mexico, GDP advanced 3.1%, led by secondary activities with 3.3%, particularly manufacturing, up 5.2%. The service sector grew 2.8% and retail 5.5%.

The Mexican peso closed the year at 19.50 against the US dollar, an annual appreciation of 5.0%. The spread between Mexican and US interest rates broadened gradually during the year, as Banco de México hiked its benchmark rate eight times from 5.50% at the close of 2021 to 10.50% at the close of 2022, while the US Federal Reserve raised its rate from 0.25% to 4.50% in the same period.

Since the end of 2021, the lingering effects of the pandemic have pushed up the cost of marine container transport by five times their former value, the average price of steel tripled, and a shortage of semiconductors increased automobile prices. Early in 2022, Russia’s unconscionable invasion of Ukraine raised the prices of food, fertilizers, energy and other commodities, which combined with other factors to raise global inflation to levels not seen since the 1980s. In Mexico, inflation closed 2022 at 7.82%, after peaking at 8.70% in September. The core index, which includes goods and services, grew 8.35%, while non-core inflation—made up of food and energy—increased 6.27%.

Mexico’s trade balance for 2022 was a deficit of USD 26.42 billion, rising from a deficit of USD10.94 billion the year before. Within exports, manufacturing rose 16.6%, while imports rose across the board, with a particularly strong 29.4% growth in consumer goods. The price of Mexico’s export blend of oil rose from an average of USD64.60/barrel in 2021 to USD89.26/barrel in 2022.

3.1%

growth in GDP in 2022

National government finances were stable, thanks to higher tax revenues and restrained current spending. The budget balance was MXN978.53 billion for the year, equivalent to 3.4% of GDP, a little higher than the 2.9% reported in 2021, due to interest rate increases that affected financial costs in 2022. Public-sector debt shrank from 50.8% of GDP to 49.4%.

In 2023 the world’s economy is expected to slow down due to restrictive policies by central banks across the globe, in an effort to bring inflation back down to their long-term targets; Mexico’s economy is prepared, however, and should position itself to take advantage of the shift in US-China trade relations to promote domestic and international investment, refocus supply chains and production of goods toward the United States instead of Asia, and forge even closer trade ties with our neighbor to the north.

Our country’s economy is prepared, however, and should position itself to take advantage of the shift in US-China trade relations

Report on Opsimex operating and financial results

The following are some remarks on the key figures reported in our financial statements for the close of 2022, which are attached to this report, including the opinion of the Independent Auditor.

Opsimex began fiscal year 2022 with a portfolio of 20,049 income-generating sites. During the year, 1,653 sites were added to revenues, 1,265 of them built during the year, 194 acquired by Opsimex and 194 by Fideicomiso Opsimex 4594 (FSites, established as a FIBRA, the Mexican equivalent of a U.S. REIT), to end the year with a consolidated portfolio of 21,702 towers, 8,273 of them directly owned by Opsimex, 13,122 owned by FSites and 307 owned by Telesites Costa Rica.

Over the course of the year, 630 new colocation contracts were added to revenues, bringing our consolidated tenancy ratio of 1.267 operators per tower by the end of 2022.

The Company reported total revenues of 10.9 billion pesos, a 21.1% growth compared to the previous year, primarily the result of the increased number of sites and the new colocations booked during the year. EBITDA closed at 10.3 billion pesos, 22.6% higher than the year before, and the EBITDA margin ended the year at 94.5%.

Capital expenditures by Opsimex in 2022 totaled 4.0 billion pesos, including 2.6 billion pesos for the acquisition of 388 towers by FSites and Opsimex. On February 18, 2022, Opsimex shareholders approved distribution of dividend totaling 1.6 billion pesos, which was paid on May 30, 2022.

Opsimex continues to focus on generating stable growth, based on the constant expansion of its clients’ networks and the construction of the telecommunication towers they require. The FSites portfolio grew from 11,683 revenue-generating towers to 13,122 at the end of 2022.

The company and its subsidiaries have an optimum financial structure for continuing the rate of organic growth they have shown in the past, while remaining open to opportunities that may arise in the market. We are optimistic that the growth trend will maintain this stability going forward.

Opsimex reiterates the pledge it has made to employees, clients and suppliers, to abide by the quality standards and thus to keep this company growing.

Fellow shareholders: We are grateful for the trust you have placed in Operadora de Sites Mexicanos, S.A.B. de C.V., and on behalf of our entire work team, we reiterate our commitment to continually improving the performance of this company’s activities.

Sincerely,

Gerardo Kuri Kaufmann

Juan Rodríguez Torres

Executive Committee

Operadora de Sites Mexicanos, S.A.B. de C.V.

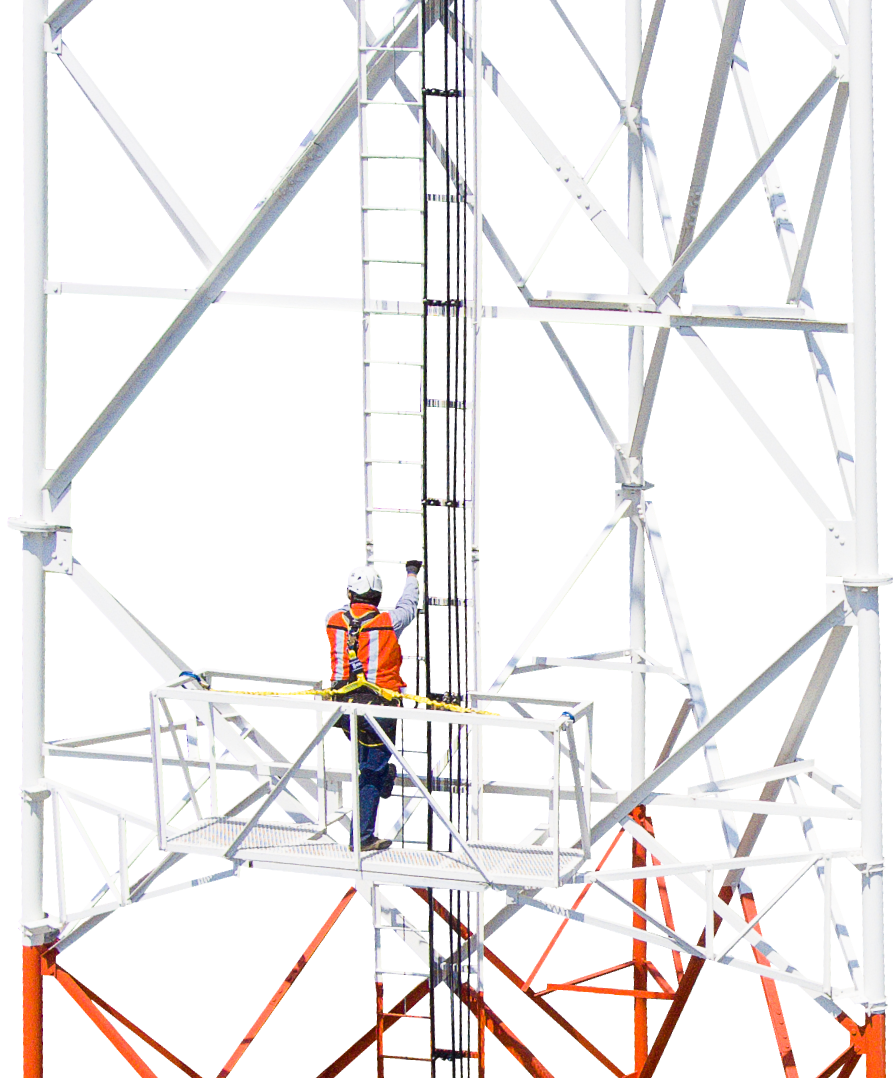

SOLID

GROWTH

Opsimex continued its steady growth in 2022, adding 1,653 towers to its portfolio during the year, 388 of them acquired in December and the other 1,265 built over the course of the year.

In terms of colocations, 630 additional rents were added to our revenues in 2022, bringing the total to 4,246 rents. As a result, Operadora de Sites closed the year with a portfolio of 21,702 towers and a tenancy ratio of 1.267 tenants per tower.

1,653

sites added in 2022

OPSIMEX OPERATING SUMMARY

Revenues

MXN billion

10.87

EBITDA margin

%

94.3

EBITDA

MXN billion

10.26

Results

Revenues totaled 10.87 billion pesos in 2022, rising 21.5% compared to 2021. Tower rental revenues came to 7.56 billion pesos. The EBITDA margin for the year was 94.3%, with EBITDA totaling 10.26 billion pesos.

At the close of the year, the company held debt totaling 41.79 billion pesos and a cash position of 4.89 billion pesos, which means net debt stood at 36.90 billion pesos.

MXN 10.87

billion in total revenues

1,439

sites added in 2022

FIBRA SITES

Fsites began 2022 with a portfolio of 11,683 revenue-generating sites. During the year, another 1,439 sites were added, 194 of which were acquired in December and the rest were built over the course of the year. At the end of the year, FSites reported a tenancy ratio of 1.282 rents per tower.

FSITES OPERATING SUMMARY

Results

FSites, which is organized as a real-estate investment trust (FIBRA in Spanish), reported total revenues of 6.36 billion pesos, which is a 46.0% increase compared to the previous year. EBITDA closed at 5.99 billion pesos, growing 48.1% year-over-year, while the EBITDA margin stood at 94.2% at the close of 2022.

FSites paid out dividends against the 2022 fiscal-year results totaling 1.50 billion pesos, equivalent to 100% of its tax earnings.

6.36

billion pesos in total revenues

Revenues

MXN billion

6.36

EBITDA Margin

%

94.2

EBITDA

MXN billion

5.99

BOARD OF DIRECTORS

Our Board of Directors is currently made up of six (6) regular directors with no designated alternates. Our corporate bylaws stipulate that the Board of Directors must have between five and twenty-one directors and up to an equal number of alternate directors. Directors need not be shareholders, but a majority of the directors and their alternates must be Mexican citizens and elected by Mexican shareholders.

Directors and their alternates are appointed or reelected at each annual general shareholders’ meeting. In accordance with the Mexican Securities Market Act (LMV), qualifying the independence of directors is the responsibility of the shareholders’ meeting, though the Mexican Banking and Securities Commission (CNBV) may challenge this qualification. Pursuant to our bylaws and the LMV, at least 25% of board members must be independent. Currently 50% of our directors are independent, a proportion higher than that required by law. Meetings of the Board of Directors may be legally called to order when a majority of its members are present.

Our bylaws also state that the members of the Board of Directors are elected for a term of one year. In accordance with the General Commercial Corporations Law (LGSM), however, members of the Board remain in their positions after the expiration of their terms for up to an additional thirty (30) -day period if new members are not elected and substitutes have either not been designated for the departing member, or have not yet assumed their duties. Furthermore, under certain circumstances provided for under the LMV, the Board of Directors may elect temporary directors who then may be ratified or replaced at the shareholders’ meetings.

The following is a list of the current members of the company’s Board of Directors, their position on the Board, their business experience and other board experience, most of which were recently appointed as board members of the Company in a general annual shareholders’ meeting held April 28, 2023, on the understanding that these individuals had served as board members of Telesites prior to its entry to the National Securities Registry (RNV) and the listing of the company’s stock on the Mexican Stock Exchange.

| Name | Title | Type | Years as board member | Gender |

|---|---|---|---|---|

| Juan Rodríguez Torres | Chairman | Independent | 7 | Male |

| Gerardo Kuri Kaufmann | Regular Member | Non independent | 7 | Male |

| Daniel Goñi Díaz | Regular Member | Independent | 1 | Male |

| Daniel Díaz Díaz | Regular Member | Non independent | 7 | Male |

| Víctor Adrián Pandal González | Regular Member | Non independent | 1 | Male |

| Luis Ramos Lignan | Regular Member | Independent | 1 | Male |

For the moment, all of the members of the board are male.

Verónica Ramírez Villela and Eriván Urióstegui Hernández serve as secretary and secretary pro tem, respectively, of the Board of Directors of Operadora de Sites Mexicanos, but are not members of that board. We believe that the participation of a woman in these activities from the time of our founding promotes a philosophy of gender inclusiveness in the formation of our governance bodies.

The following are brief profiles of each of our board members:

-

Juan Rodríguez Torres

Mr. Rodríguez received a bachelor’s degree in civil engineering from the Universidad Nacional Autónoma de México. He is 83 years old. He is a board member of Grupo Sanborns, S.A.B. de C.V. and Elementia, S.A. de C.V. (for which he also serves as member of the audit and corporate practices committee), Fortaleza Materiales, S.A.P.I. de C.V. and chairman of its audit and corporate practices committee; Minera Frisco, S.A.B. de C.V. (also chairman of its audit and corporate practices committee), Fomento de Construcciones y Contratas, S.A. and Cementos Portland Valderribas, S.A. and their respective committees. Non-executive chairman of the real estate group REALIA Business, S.A. He is chairman of board of directors of the Red Nacional Última Milla, S.A.P.I. de C.V. and Red Última Milla del Noroeste, S.A.P.I. de C.V. All of the aforementioned companies are considered related or associated parties of the Administrator. Mr. Rodríguez is the founder of various companies in the real estate and footwear industries, as well as board member of Procorp, S.A. de C.V., a real-estate investment company, and a member of the advisory board of Grupo Financiero Banamex. He is currently Chairman of the Board of Directors, member of the audit and corporate practices committee and of the Company’s Executive Committee.

-

Daniel Díaz Díaz

Bachelor’s degree in civil engineering from the Universidad Nacional Autónoma de México. He is 89 years old. He served in the public sector as undersecretary for Infrastructure and Secretary of Communications and Transportation. From 1990 to 1997 he served as a member of the board of the Universidad Nacional Autónoma de México. Mr. Díaz was general director of the Instituto Mexicano del Transporte and, from 2000 to 2001, general director of Caminos y Puentes Federales de Ingresos y Servicios Conexos. From 2003 to 2005 he was an infrastructure project advisor to the Fundación del Centro Histórico de la Ciudad de México, A.C., and currently serves on the boards of Carso Infraestructura y Construcción, S.A. de C.V., Impulsora del Desarrollo y el Empleo en América Latina, S.A.B. de C.V., Red Nacional Última Milla, S.A.P.I. de C.V. and Red Última Milla del Noroeste, S.A.P.I. de C.V.

-

Luis Ramos Lignan

Undergraduate degree in Civil Engineering and a master’s degree in hydraulics from the Universidad Nacional Autónoma de México. He is 83 years old. He has served as chairman of the Colegio de Ingenieros Civiles de México, the Cámara Nacional de Empresas de Consultoría, A.C., the Asociación de Ingenieros y Arquitectos de México, A.C., the Instituto Mexicano de Auditoría Técnica, A.C., and the Technical Committee of the Fideicomiso Fondo para el Financiamiento de Estudios para Proyectos de Infraestructura. Currently he is chairman and CEO of Ingeniería y Procesamiento Electrónico, S.A. de C.V.

-

Daniel Goñi Díaz

Undergraduate degree in law from the Universidad Nacional Autónoma de México. He is 71 years old. He is notary public number 80 in the State of Mexico and has served as secretary, vice president and president of the Mexican Red Cross on several occasions. He has also been citizen board member of the State of Mexico Electoral Commission. Mr. Goñi Díaz sits on the board of directors of Red Nacional Última Milla, S.A.P.I. de C.V. and Red Última Milla del Noroeste, S.A.P.I. de C.V.

-

Víctor Adrián Pandal González

Undergraduate degree in Business Administration from the Universidad Iberoamericana. He is 49 years old. He also holds a master’s in business administration from Boston University. From April 2002 to December 2018, he was general director of the Fundación del Centro Histórico de la Ciudad de México, A.C. Currently an independent consultant and founding member of HAN Capital, a real-estate investment fund.

-

Gerardo Kuri Kaufmann

Holds a bachelor’s degree in industrial engineering from the Universidad Anáhuac. He is 39 years old. From 2008 to 2010, he served as purchasing director of Carso Infraestructura y Construcción, S.A. de C.V. Since the founding of Inmuebles Carso, S.A.B. de C.V., and until April 2016, he was CEO of that company, and today is a member of its board, as well as of the board of all its subsidiaries. He is also a member of the board of directors and CEO of Minera Frisco, S.A.B. de C.V., board member of Elementia Materiales, S.A. de C.V., Realia Business, S.A., Fomento de Construcciones y Contratas, S.A. (where he sits on the Executive Committee), Cementos Portland Valderrivas, S.A. (also delegate board member of that company) and Carso Infraestructura y Construcción, S.A. de C.V. Alternate chairman of the Board of Fortaleza Materiales, S.A.P.I. de C.V. He is currently a member of the company’s Executive Committee.

There is no relationship, by blood or by marriage, between members of the Company’s Board of Directors and its senior executives.

The Company does not maintain pension, retirement or other such plans for members of the Board of Directors, senior executives or other parties that may be considered related to the Company.

The Audit and Corporate Practices Committee is made up of the following individuals (all of them independent board members according to the LMV definition).

| Name | Position | Type |

|---|---|---|

| Luis Ramos Lignan | Chairman | Independent |

| Juan Rodríguez Torres | Member | Independent |

| Daniel Goñi Díaz | Member | Independent |

All members of the Audit and Corporate Practices Committee have extensive experience and an established professional career either as entrepreneurs, public officials or in the private sector. Most of them are or have been board members of various companies in the financial or securities industry and have served in federal public administration and de-centralized government agencies.

REPORT OF THE AUDIT AND CORPORATE PRACTICES COMMITTEE

TO THE BOARD OF DIRECTORS OF OPERADORA DE SITES MEXICANOS, S.A.B. DE C.V.

In accordance with article 43, sections I and II of the Mexican Securities Market Act (LMV, by its initials in Spanish), and pursuant to the recommendations contained in the Code of Best Corporate Practices published by the Mexican Business Coordinating Council on behalf of the Audit and Corporate Practices Committee of Operadora de Sites Mexicanos, S.A.B. de C.V. (the “Company”), we hereby present to you our report on the activities carried out by this corporate committee in fulfillment of its duties during the fiscal year ended December 31, 2022.

One of the basic responsibilities of Company management is to issue financial statements that have been prepared on the basis of applicable financial reporting standards. These financial statements should reflect in a clear, sufficient and up-to-date manner, the operations of the Company and the corporations it controls. Furthermore, Company management is charged with introducing appropriate internal control and internal audit systems, and appropriately and promptly disclosing any material information on the Company and the corporations it controls, for the investing public as provided for by law.

As an auxiliary body of the Board of Directors, the Audit and Corporate Practices Committee is responsible for overseeing the management, direction and execution of the Company’s businesses and those of the corporations it controls, and for verifying the Company’s compliance with various operating and internal control procedures. Accordingly, the Company’s Audit and Corporate Practices Committee has reviewed the consolidated financial statements with figures as of December 31, 2022, and the opinion of the Company’s internal auditor and Independent External Auditor regarding that information.

In fulfillment of its primary audit responsibilities, the Committee carried out the following activities:

- We evaluated the performance of Despacho Mancera, S.C., a member of Ernst & Young Global Limited (“Mancera”), and found it acceptable; accordingly, we recommended that the Board of Directors ratify its engagement as Independent External Auditor for the task of reviewing the financial statements and preparing the corresponding financial opinion on the Company and the corporations it controls, for fiscal year 2022. Furthermore, we verified the appropriate preparation and presentation of intermediate financial information by the Company, ascertaining that it was clear, precise, and met all international financial reporting standards.

- Prior to the engagement of Mancera as Independent External Auditor, we ascertained that said firm: (i) met the personal, professional and independence criteria established in the applicable law and provisions for rendering such services; and (ii) presented its statement of compliance with the corresponding quality control standard for the fiscal year audited. We also reviewed the terms of the audit agreement.

- We approved the fees paid to the Independent External Auditor and its work plan for examining the financial statements of the Company for fiscal year 2022.

- We maintained effective communications with the Independent External Auditor regarding the activities carried out for preparing its opinion on the Company’s financial statements.

- We observed no relevant cases of non-compliance with the operating or accounting guidelines or policies of the Company or its subsidiaries as of December 31, 2022.

- The Company required services other than those of the external audit from the Independent External Auditor during the fiscal year. Those services were engaged following an analysis of their suitability in terms of the applicable legal provisions considering the independence of the External Auditor.

- We reviewed the financial statements for the Company and its subsidiaries as of December 31, 2022, the report of the internal auditor and the Independent External Auditor’s report, and the accounting policies used in preparing the financial statements and verified that all necessary information was disclosed in keeping with current regulations.

- There were no modifications and/or approved authorizations regarding the accounting policies of the Company or its subsidiaries for fiscal year 2022.

- We followed up on implementation of the policies and processes of the Company and the corporations it controls regarding risk management, internal control and auditing, as well as the status of the internal control system. This Committee was informed of various nonmaterial deficiencies or discrepancies detected by the internal audit area, and Company management informed us of the measures taken to correct them; it should be noted that we detected no relevant breaches of the internal control policies established by the Company.

- We approved the work program for the internal auditor for fiscal year 2022 and verified that it was carried out.

- We supported the Board of Directors in preparing the reports referred to in article 28, section IV of the Securities Market Act.

- We reviewed and recommended that the Board of Directors approve the transactions carried out by the Company under the terms mentioned in article 28 of the Securities Market Law, particularly with regard to transactions with related parties, ascertaining that these were carried out at market values and on the basis of the corresponding transfer price studies. We also saw to it that these transactions were reviewed by the Company’s Independent External Auditor, as indicated in the corresponding note to transactions with related parties in the report on the consolidated financial statements of the Company with data as of December 31, 2022.

- We followed up on the resolutions of the shareholders’ meeting and the board of Directors.

Additionally, and in fulfillment of its primary Corporate Practices duties, the Committee carried out the following activities:

- Evaluated the performance of the Executive Committee and key executives of the Company and its subsidiaries, as well as their performance as administrator of the OPSIMEX 4594 Trust.

- Reviewed and followed up on transactions with related parties, which were carried out during the ordinary course of business and under market conditions.

- Analyzed the process of hiring and compensation of Company employees, the CEO and other key executives, including emoluments paid to Board Members.

- Based on our analysis of the results of the Company and the various meetings held with the Executive Committee and key executives, we deem their performance in fiscal year 2022 to have been satisfactory.

- We received no request whatsoever for the exemptions referred to in article 28, section III, point f) of the Securities Market Act

- Continued supervision of the Company’s corporate and legal situation, verifying that it remained in compliance with the applicable laws and regulations.

No observations were received from shareholders, board members, the Executive Committee, key executives, employees or outside parties regarding accounting practices, internal controls or issues relating to internal or external audits of the Company, nor were there any reports of material actions or situations deemed irregular in its administration or which may have had an adverse effect on the Company’s financial situation.

We have reviewed the consolidated financial statements of the Company for the fiscal year ended December 31, 2022, and the opinion of the Independent External Auditor, finding that they were prepared in accordance with accounting policies, procedures and practices consistent with financial reporting standards, and we agree with the content of that opinion as we believe they reasonably reflect the financial position of the Company as of December 31, 2022. We believe the management, direction and execution of the Company’s businesses during fiscal year 2022 was carried out appropriately by Company management.

We make the foregoing statement for the purpose of complying with the obligations entrusted to this corporate body and provided for in the Securities Market Act, and with any other duty that has been or is entrusted to us by the Company’s Board of Directors, further noting that in the preparation of this report we took into account the opinion of key executives of the Company.

Sincerely,

Luis Ramos Lignan

Chairman of the Audit and Corporate Practices Committee of Operadora de Sites Mexicanos, S.A.B. de C.V.

INVESTOR INFORMATION

Investor Relations

Mariana Carrillo Herrera

relacionconinversionistas@telesites.com.mx

Stock information

Series A1 shares of Operadora de Sites Mexicanos, S.A.B de C.V. are listed on the Mexican Stock Exchange under the ticker symbol “SITES1”.

Website

https://www.telesites.com.mx

Headquarters

Av. Paseo de las Palmas No 781, 7th floor, Offices 703-704,

Col. Lomas de Chapultepec III Sección

postal code 11000 Miguel Hidalgo, Mexico City